A notable risk is that, because BNPL providers do not or cannot check customer credit scores, there is a real risk that consumers who are already in debt, will become overindebted as a result of being able to access (sometimes multiple) BNPL options easily.Īs the BNPL and other credit facilities are becoming more prominent, particularly in the current cost-of-living crisis in Ireland and elsewhere, educating consumers and regulating pay-later options is an important step in curbing overconsumption, as well as supporting sustainability and the circular economy. Nevertheless, as deferred payment systems are becoming more common, along with other loans such as (re)mortages, car leasing, and personal loans, there is a risk of financial debt becoming the norm in society, even for everyday expenses such as food delivery (via Klarna on Deliveroo Ireland, for example), not just long-term necessities, such as housing, transport, renovation, etc.

#Buy now pay later catalogues ireland full#

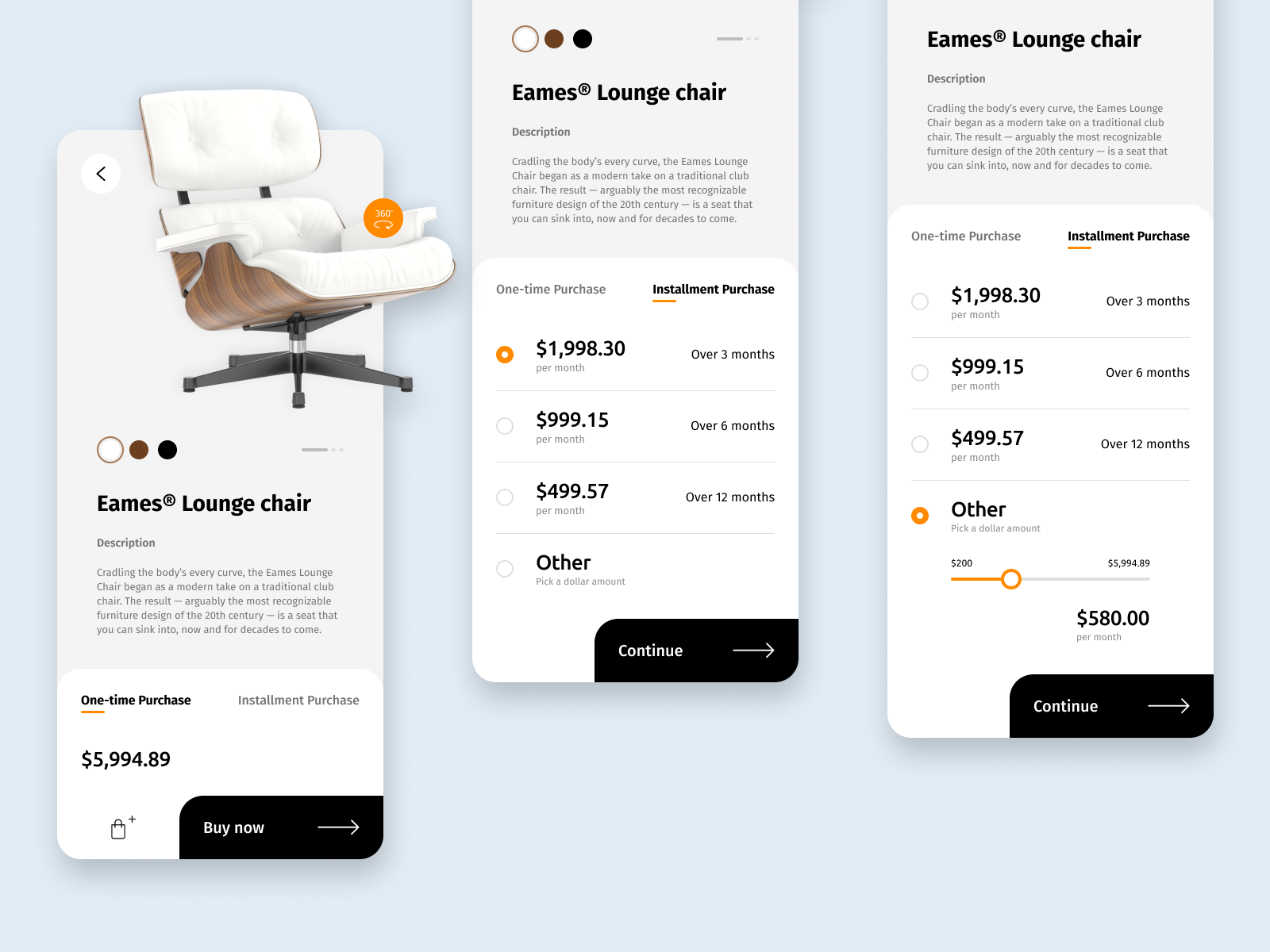

Opting for a deferred payment or an instalments schedule also means that the e-commerce model is changing: customers can pay only a small percentage of the cost, have it delivered, have the opportunity to test it and then return it, if unsatisfactory, before having to make a full payment.

It also reverses the financial burden on the consumer having to pay for a product in full online, only to return it upon receipt and then wait for the refund of the full amount.

Indeed, webshops report a higher level of consumer trust, and therefore higher purchasing incentives. There are many consumer benefits to BNPL, such as flexibility and convenience. The online merchants support the BNPL fees instead. The option is attractive as, generally, is a fee-free, interest-free finance/loan arrangement for consumers, as long as they repay the borrowed amount within the agreed period. Many shoppers may perceive BNPL options as an on-the-spot checkout alternative to credit cards. Why use BNPL?īNPL plans can be a convenient option for customers who don’t have the full amount required for a purchase or prefer to spread out payments over time. The BNPL provider pays the merchant for the purchase and the consumer then pays the BNPL provider usually within 30 days. The payment plan is in effect a form of credit option offered in partnership with accredited banks, within a framework of flexible financing, whereby the creditor effectively gives the consumer (the customer/buyer) a loan by paying the merchant (online store). The specific terms of the plan, such as the number of payments and the interest rate, can vary depending on the provider and the online store. In this process, the customer is required to make an initial payment at the time of purchase, which is usually a percentage of the total cost, and then make additional payments over a set period of time. Known as ‘BNPL’, it is now becoming a common payment plan, particularly in the online shopping sphere, represents an alternative to paying the full amount upfront, and is typically offered at the check-out page on participating online stores via a third party such as a ‘fintech’ (financial technology firms) or ‘paytech’ (payments technology company) entity such as Afterpay, Klarna, PayPal or the merchant itself (through own credit facility, such as Apple Pay Later, Zalando Invoice Payment, Very Ireland Delayed Payment, Revolut Ireland BNPL). A ‘buy now – pay later’ plan is a type of purchase financing option that allows customers to buy products online and pay for them over a certain period of time, in instalments.

0 kommentar(er)

0 kommentar(er)